Summary

Since 2014, Russia’s de-dollarization plan has been guided by security and geopolitical considerations. By dumping the US dollar from its foreign currency reserves, Russia diverted from the traditional approach where liquidity and the credibility of the issuer determine the choice of currency.

In 2022, Russia has doubled down on its efforts to de-dollarize the economy. What started as de-dollarization in 2014, transformed into full-blown rouble-ization in 2022.

Following the dynamic of an emerging multipolar world order, the global financial system is also gravitating towards fragmentation and currency multipolarity. The overuse of sanctions could strengthen revisionist countries’ desire to increasingly conduct their trade in non-dollar currencies in an attempt to avoid US oversight.

If current trends continue, the de-dollarization effort could gain ground and undermine the primacy of the US dollar.

Introduction

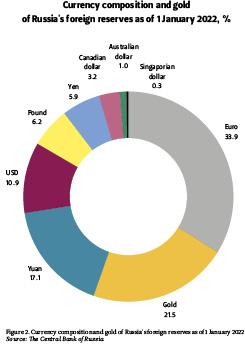

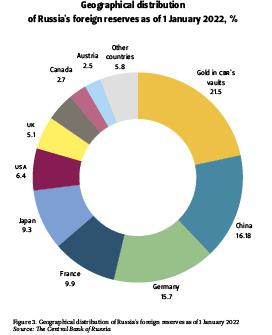

In response to Russia’s invasion of Ukraine, the West imposed sweeping economic sanctions to erode Moscow’s ability to fund its invasion. Several Russian banks were disconnected from SWIFT, and Russia’s largest banks such as Sberbank and VTB were placed on the full blocking sanctions lists. More than half of the Central Bank of Russia’s $640 billion foreign reserves were frozen. The West weaponized its financial system in a way that marked a historic shift. In the past, such a measure has never been applied to a G20 economy before. Russia’s diversification of foreign currency reserves to euros, yen and pounds proved to be futile. The decision crippled Russia’s ability to shield itself against Western sanctions, prop up its currency, and sustain its economy.

Since February 2022, the Kremlin has doubled down on its efforts to securitize the country’s economy, pivot away from the US dollar, and promote the Russian rouble in international trade. Russia’s de-dollarization effort coincides with China’s strategy to dent the dominance of the US dollar and internationalize its currency. If other countries support this trend, the de-dollarization movement could reduce the share of the US dollar in the global financial system.

This Briefing Paper will examine Russia’s de-dollarization strategy since 2014 and analyze the role of Asia on the level of international reserves and trade settlements, and in the build-up of alternative financial infrastructures. It will also consider the implications of de-dollarization for the US dollar hegemony and the global financial system.

Russia’s financial sovereignty

For years, Russia has sought to limit its exposure to the US dollar, a campaign that accelerated after 2014 when Moscow annexed Crimea, and the West imposed economic sanctions in retaliation. The push towards de-dollarization was perceived as an important step towards strengthening Russia’s financial and economic sovereignty. To insulate its economy against US pressure, the Russian government adopted a multi-pronged approach: to change the structure of international reserves, to increase trade settlements in non-dollar currencies, and to build a non-US-centred financial infrastructure. Moscow’s approach was guided by security and geopolitical considerations. It contrasted with the traditional approach where the choice of currency is determined by its liquidity and the credibility of the issuer.[1]

First, the Russian government accrued an immense stockpile of foreign currency and gold – almost $640 billion, the fifth largest in the world. After 2014, the currency composition of international reserves changed dramatically. The Central Bank of Russia (CBR) cut the share of its reserves denominated in dollars by more than half. The US dollar accounted for 16.4% of reserves in 2021, down from 43% in 2014. Following US sanctions in 2018, the Russian government dumped $101 billion of US Treasury securities. The share of gold in Russia’s currency reserves more than tripled, amounting to over 20% of the value and surpassing the dollar. The share of the yuan jumped from zero in 2014 to 13% in 2021, making Russia the largest holder of the Chinese currency worldwide.

Diversifying from the dollar in international reserves proved to be easier than pivoting away from the greenback in trade settlements. While Russian banks have successfully pivoted away from the dollar, the non-financial sector, including households, has preferred dollar assets despite the increased risks of US sanctions. As a result, the top-down-driven de-dollarization has led to a public-private divide.[2]

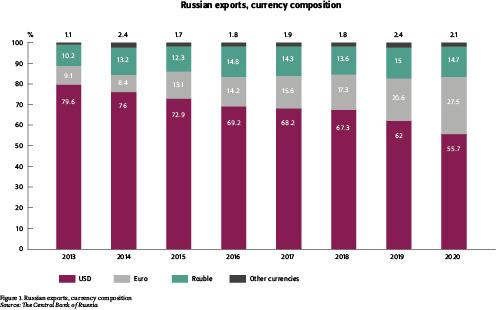

Nevertheless, Russia managed to reduce the share of trade conducted in dollars: between 2013 and 2020, the share of the dollar in Russia’s exports dropped from almost 80% to 55%. Russian state-owned energy majors started to include other currencies in their contracts: Gazprom and Rosneft began to add the euro as the default currency in their new export contracts. The move coincided with the EU’s push to bolster the international role of the euro.

Finally, the Russian authorities developed payment processing capabilities to pivot away from the dollar-centred financial infrastructure. In 2014, the Russian government created the National Payment Card System “Mir” as the alternative to Visa and Mastercard, and the System for Transfer of Financial Messages (SPFS) as the alternative to SWIFT. Since 2014, the Russian authorities have sought to popularize the Mir cards, but their rapid growth – 25.7% of all domestic transactions in 2021 – can largely be attributed to the state’s top-down approach: the cards are mandatory for people receiving budget payments such as public welfare. Making payments outside of Russia remains the weakest spot. The same applies to Russia’s SPFS: the system lacks the network effect – the majority of SPFS’s participants (about 400 institutions) are mainly Russian banks and exporters. Russia tried to promote its alternatives in multilateral organizations such as the Eurasian Economic Union (EAEU) and BRICS, which consists of Brazil, China, South Africa, India and Russia, but the effort did not bear fruit. Another pillar of Russia’s de-dollarization efforts is the introduction of the digital rouble. In early 2022, the CBR started testing the prototype of the digital rouble platform with financial market participants. Moscow’s motivation was driven by the desire to reduce dependency on the US dollar and blunt sanctions risks.[3]

While these steps did not make Russia immune to Western sanctions, they laid the groundwork for the country’s financial de-coupling. The latest sanctions over Russia’s invasion of Ukraine accelerated the Kremlin’s desire to securitize its economy and insulate it against Western oversight.[4] What started as de-dollarization in 2014, transformed into full-blown rouble-ization in 2022.

From de-dollarization to rouble-ization

Russia’s official strategy of de-dollarization started after the Trump administration adopted the Countering America’s Adversaries Through Sanctions Act (CAATSA) in 2017. The Kremlin’s push towards insurgency against the dollar strengthened when the US sanctioned Russian billionaire Oleg Deripaska’s companies, which roiled global aluminium markets in 2018. With the measures against Deripaska, the Trump administration signalled that no Russian company was big enough to be spared sanctions. Speaking at the Valdai Club, Vladimir Putin criticized the US weaponization of finance that was “undermining trust in the dollar as a universal payment instrument and the main reserve currency”.[5]

The original de-dollarization plan was formulated by VTB and its CEO Andrei Kostin. The plan was meant to be a part of Russia’s long-term strategy to insulate the Russian market against external pressure and contribute to the development of the domestic financial system. The de-dollarization plan was multifaceted: 1) shifting trade settlements for Russian exporters from dollars to roubles and other currencies; 2) moving the registration of major Russian companies from offshores to Russian jurisdiction; 3) transferring the Eurobond market infrastructure to Russia and replacing Euroclear and Clearstream (clearing and settlement systems for debt securities) with a Russian equivalent; 4) encouraging Russian issuers to list their shares on the Moscow Stock Exchange (MOEX); 5) creating Russian platforms for operations with hedging instruments in the commodity markets; 6) establishing a Russian clearing centre for operations with precious metals; and 7) aligning only selectively with international financial regulations which can be used against Russia.[6] The plan was originally scheduled to be implemented in 2024.

The de-dollarization plan was envisaged to be incremental, as opposed to abandoning the dollar immediately and entirely. Russian elites acknowledged that the volatility of the rouble was the main hindrance. Alexei Kudrin, former Finance Minister, pointed to these limitations: “Global settlements require a more stable unit of measurement. In this sense, the rouble, falling twice a year, has no such property. Therefore, switching to rouble settlements is an additional currency risk and, in fact, a tax. Are we ready to move away from the dollar and pay a special additional tax for this security?”[7]

However, the Western response to the invasion of Ukraine has brought about a significant change in the Russian approach to de-dollarization. The main blow came from freezing more than half of the country’s $640 billion foreign reserves, which obliterated Moscow’s war chest. The measure took the Russian elites by surprise. Later, Sergey Lavrov, Russia’s longstanding Foreign Minister, acknowledged it: “When they [froze] the central-bank reserves, nobody who was predicting what sanctions the West would pass could have pictured that. It’s just thievery.”[8] The effect of the measure was amplified by the fact that it wasn’t discussed in public and the information was closely guarded on both sides of the Atlantic.

After the invasion of Ukraine, the Kremlin doubled down on the securitization of all financial spheres. Any economic considerations of the de-dollarization plan that had existed before duly evaporated. Unlike in 2014, the plan has become not so much to de-dollarize, but to ‘russify’ the country’s financial system, by switching to rouble-denominated payments whenever possible. Despite its volatility, payments in roubles became a geoeconomic necessity and were viewed as a guarantee that neither reserves nor revenues can be frozen. Russia’s recent demands to switch to rouble payments for gas trade with Europe is an example of this. The move is a political act which would minimize the risks of Iran-style sanctions when revenue from energy exports were frozen in an escrow account. By designating Gazprombank for all energy-related transactions, the Kremlin has de facto shielded the bank from any restrictions as long as Europe continues buying Russian oil and gas.

Moscow’s decoupling effort has gone beyond “currency onshoring”. In the space of a month, the Kremlin pressed on with the remaining steps of the de-dollarization plan. Russia’s drive to use the national currency has extended to other commodity exports such as oil, metals, wheat, and fertilizers. The Ministry of Finance proposed prohibiting the use of foreign currency in public procurement contracts. A new decree was issued to prohibit the listing and trading of Russian companies’ shares abroad and to allow dividend payments only on rouble-denominated securities. Tinkoff Bank launched trading in precious metals at the MOEX, which are physically stored in the country’s vaults and thus cannot be frozen abroad.

Doubling down on a pivot to Asia

Since 2014, a pivot to Asia has been an integral part of Russia’s de-dollarization effort. A connection with Asia was tangible on the level of international reserves, trade settlements, and in building an alternative financial infrastructure. After the invasion of Ukraine, Russia has sought to expand on the existing relationships and promote its anti-dollar movement.

China and India have emerged as the key partners of Russia’s de-dollarization plan. Neither Beijing nor New Delhi condemned Russia’s invasion of Ukraine, nor joined Western sanctions. For both China and India, the war in Ukraine has represented a unique opportunity to strengthen their strategic partnership with Russia and to accelerate the build-up and expansion of their alternative financial infrastructure.

Prior to 2022, Russian banking institutions had a limited history dealing with the yuan, which was often perceived as an exotic currency. Moscow and Beijing established cooperation on a new international payment system and launched the currency swap lines, but progress remained largely on the level of technical consultations. In Sino-Russian trade, the euro emerged as the main beneficiary of both countries’ de-dollarization efforts: in 2020, more than 83% of Russian exports to China were settled in euros, while the share of yuan remained small.

After the invasion, Russian banks embraced the yuan with greater enthusiasm. Since March 2022, every third new foreign currency account at Russia’s banking institutions has been opened in the Chinese currency. After Visa and Mastercard suspended their foreign transactions, Russian banks flocked to China’s UnionPay system. Co-badging with UnionPay was already in place prior to 2022, but it was hardly used. The demand for UnionPay cards surged dramatically: the number of Chinese cards issued since the invasion has increased tenfold. Other major Russian banks such as Sberbank, Alfa Bank and Tinkoff Bank began the process of issuing co-badged cards, but due to secondary sanctions risks UnionPay declined processing any Russia-issued cards abroad.

The vast majority of Sino-Russian trade has traditionally been conducted in dollars and euros, but with the unprecedented sanctions that is changing too. China has started paying for Russian coal in yuan. Other Russian commodity producers are also switching to the Chinese currency. The Chinese authorities have not ruled out the possibility of using roubles or yuan in energy trade with Russia.

India has been exploring a rouble-rupee trade agreement following the new sanctions. The agreement goes back to the Soviet times when payments in national currencies were facilitated. Since 2014, Moscow and New Delhi have boosted their national currencies in the bilateral trade. Between 2014 and 2019, the trade in roubles and rupees increased fivefold – from 6% to 30%. The countries inked their military deals, including the purchase of S-400 air defence systems, in rupees to avoid US sanctions risks. Alrosa, the world’s largest producer of diamonds, initiated a rupee-rouble payment arrangement for its Indian clients.

Since the invasion, Russia and India have finalized an alternative transaction platform to facilitate bilateral trade in roubles and rupees. The new system is to be installed between the Reserve Bank of India and Russia’s VEB, which is sanctioned by the West. The transactions aim to circumvent SWIFT and the exposure to the US dollar: any import or export payments will be settled through the Rupee Debt Account, using Russia’s SPFS system. The value of exports will be debited from the Rupee Debt Account and credited to the exporter’s account once the consignment is finalized. It is essentially a barter-based mechanism to avoid US sanctions, which India practised earlier with Iran. Russia has also tried to encourage India to link its Unified Payments Interface with Mir cards for seamless transactions between Indian and Russian banks.

Russia’s de-dollarization efforts and pivot to non-Western currencies will come at a cost. Firstly, Russia’s non-dollar alternatives are far less liquid. The attractiveness of Western currencies is determined by political as much as by economic factors – political stability and trust in the issuing authority. The demand for roubles, rupees and yuan is shallow, as there are difficulties with their convertibility. Given that foreign reserves are considered to be a safety net in a crisis situation, the inherent volatility of non-Western currencies makes them unreliable in terms of their value. Secondly, determining the exchange rate is the biggest stumbling block with weak currency pairs such as yuan-rouble or rupee-rouble. Intermediate currencies such as the dollar have often been used to set a fair exchange rate. This would, however, create the US nexus – a connection to the US dollar or US financial intermediaries – that allows for triggering Western sanctions. Switching to barter-based arrangements might be the only option. Finally, there are structural limitations as to the extent to which the new payment mechanisms can work. The key impediment is a small trade turnover and a skewed trade deficit. As a general pattern, Asian countries import more from Russia, mainly hydrocarbons traditionally priced in dollars, than vice versa, which makes any barter-based payment mechanism of limited use.

Ramifications for the US dollar hegemony and the global financial system

By freezing Russia’s foreign currency reserves, the West waged a financial war against Moscow unmatched in its scope and magnitude. This move, which embodied the weaponization of finance, will also have unintended consequences for the global financial system. The unprecedented sanctions have raised questions about whether central banks’ foreign reserves can be considered sanction-proof and whether the US dollar is a safe asset. Governments typically rely on reserves as the last guarantee on debt payments, but that is no longer a given if the dollar- and euro-denominated assets can be frozen overnight. It can spur governments to seek shelter outside of the dollar-based financial system. That means flocking to non-Western currencies and gold.

Even before the Russia-Ukraine war, there was a substantial shift away from the dollar to non-traditional currencies. The share of the dollar in global foreign reserves fell from 71% in 1999 to 59% in 2021. The share of non-traditional reserve currencies rose from negligible levels in the 2000s to roughly 10% in 2021.[9] One quarter of the former dollar reserves shifted towards the yuan; the remainder comprise the currencies from Canada, Australia, Singapore, South Korea and Sweden. Governments are also poised to re-think the purpose of foreign reserves for their financial defence altogether and to resort to tighter capital controls more often.

The lack of genuinely credible alternatives means that the dollar will likely remain the world’s dominant currency. No other currency comes close to rivalling the dollar with regard to its primary position in the global economy and in international financial markets – as a foreign reserve currency, the main invoicing currency, and as the dominant currency in the global equity and commodity markets. In times of crisis, the dollar is a safe asset.

Yet, in the long run, the yuan is well-positioned to reduce the share of the US dollar. As the world’s largest trading nation deeply entrenched in the global supply chains, China’s economic clout and its push towards digitalization create good preconditions for the internationalization of the yuan. The sweeping sanctions against Russia will accelerate China’s desire to chip away at the dollar’s hegemonic position and to financially decouple from Western payment channels.

The weaponization of finance is a real concern for China, which relies heavily on dollars in international trade and holds the world’s largest stock of foreign reserves – $3.25 trillion. The deteriorating US-China relations have strengthened Beijing’s belief in the need to create a credible alternative to the US-centred financial system. Chinese officials have joined Moscow’s chorus in declaring that US sanctions undermine the credibility of the US dollar. Beijing has ambitious plans to lead in global finance by promoting its currency and by building an alternative financial infrastructure.

In trade, the yuan is increasingly becoming an appealing option for those countries seeking to bypass US oversight. Commodity markets are of particular strategic importance, and here Beijing has already made the first move. Saudi Arabia and China are in talks to switch to yuan payments for oil – a milestone considering that it is traditionally traded in US dollars. If implemented, the new trade arrangement can be consequential for the de-dollarization movement. The oil market is “the first line of defense for the dollar’s status as reserve currency”.[10] Any changes in the oil market can accelerate non-dollar transactions in other commodity markets and encourage others to switch to the petroyuan, namely yuan-denominated oil contracts. The de-dollarization of these markets could trigger a snowball effect.

The yuan is also emerging as an intermediate currency for countries seeking to avoid the US nexus. Moscow and New Delhi are reportedly discussing the use of the yuan as a reference currency in their trade mechanism. Using the Chinese currency as a pricing tool would help resolve the issue with the volatile exchange rate and avoid secondary sanctions risks.

Conclusions

As the world order is transitioning to multipolarity, currency multipolarity is a logical continuation. While the emergence of an anti-dollar axis is in the distant future, the pushback against US control over financial plumbing is growing. The overuse of sanctions will further motivate others to build a parallel financial system and rally their trading partners around non-dollar currencies.

In the long term, financial decoupling is likely to accelerate in the countries vested in the de-dollarization movement – Russia, China, India, Turkey, Iran, Venezuela, and Saudi Arabia. The international financial system is likely to undergo fragmentation in line with the dynamic of a multipolar world order. It can be structured around rival blocks, in which the use of currency is determined by geopolitical alignments, not economic considerations. At the moment, Russia’s de-dollarization efforts seem disjointed and insignificant, lacking international coordination. The main danger for the primacy of the US dollar may not lie in its entire replacement, but in the decline of the dollar’s share in international trade and foreign reserves composition. If current trends continue, the de-dollarization movement could gather a critical mass, and a combination of non-Western currencies – fiat and digital – might reduce the realm of the US dollar.

Endotes

[1] Barry Eichengreen, Arnaud J. Mehl, Livia Chitu, ‘Mars or Mercury? The geopolitics of international currency choice’, National Bureau of Economic Research, Working Paper 24145, 2017, https://www.nber.org/system/files/working_papers/w24145/w24145.pdf.

[2] Dmitry Dolgin and Iris Pang, ‘Russian de-dollarization. Public-private divergence persists’, ING, 3 December 2020, https://think.ing.com/uploads/reports/Russian_dedollarisation_November_2020_%28RB%29.pdf.

[3] Maria Shagina, ‘Central Bank Digital Currencies and the implications for the global financial infrastructure: the transformational potential of Russia’s digital rouble and China’s digital renminbi’, FIIA Briefing Paper 329, January 2022, https://www.fiia.fi/en/publication/central-bank-digital-currencies-and-the-implications-for-the-global-financial-infrastructure.

[4] Mikael Wigell et al., Europe Facing Geoeconomics: Assessing Finland’s and the EU’s Risks and Options in the Technological Rivalry (Helsinki: Prime Minister’s Office, 2022), https://www.fiia.fi/en/publication/europe-facing-geoeconomics.

[5] Patrick Reevell, ‘Russian President Vladimir Putin says US dominance is ending after mistakes “typical of an empire”’, ABC News, 19 October 2018, https://abcnews.go.com/International/putin-us-dominance-ending-mistakes-typical-empire/story?id=58611354.

[6] ‘Plan to de-dollarize the Russian economy. Key points’, RBC, 4 October 2018 [in Russian], https://www.rbc.ru/economics/04/10/2018/5bb61fb69a79478a30eec190.

[7] ‘Kudrin talks about the costs of abandoning the dollar in international payments’, RBC, 6 September 2018 [in Russian], https://www.rbc.ru/economics/06/09/2018/5b9144179a794782de408d6a.

[8] ‘Lavrov says scale of Western sanctions took Moscow by surprise’, Financial Times, 23 March 2022, https://www.ft.com/content/fe9c4986-f467-49c7-a5d6-65f4e8d8fc9c.

[9] Serkan Arslanalp, Barry Eichengreen and Chima Simpson-Bell, ‘The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Currency Reserves’, International Monetary Fund, WP/22/58, March 2022, pp. 5-6.

[10] Gal Luft and Anne Korin, De-dollarization: the revolt against the dollar and the rise of a new financial world order, 2019, p. 84.